Coronavirus hits airlines as they report earnings and prepare for layoffs next fall

The major U.S. airlines will begin reporting first quarter earnings this week, and it won’t be pretty. The trade group Airlines for America (A4A) warns COVID-19 has “decimated” airline passenger volume and the carnage will continue. At the end of January there were an average 111,000 flights every day worldwide. Last week the number averaged 28,000.

In the U.S., domestic flights, as of April 18, averaged just 10 passengers even though the airlines have scrambled to cut capacity. A4A says the carriers have grounded 2,711 aircraft or 44% of the fleet and they plan to cut capacity even more. Net bookings are down 99.5% year over year and booked revenue is down 103%, according to A4A.

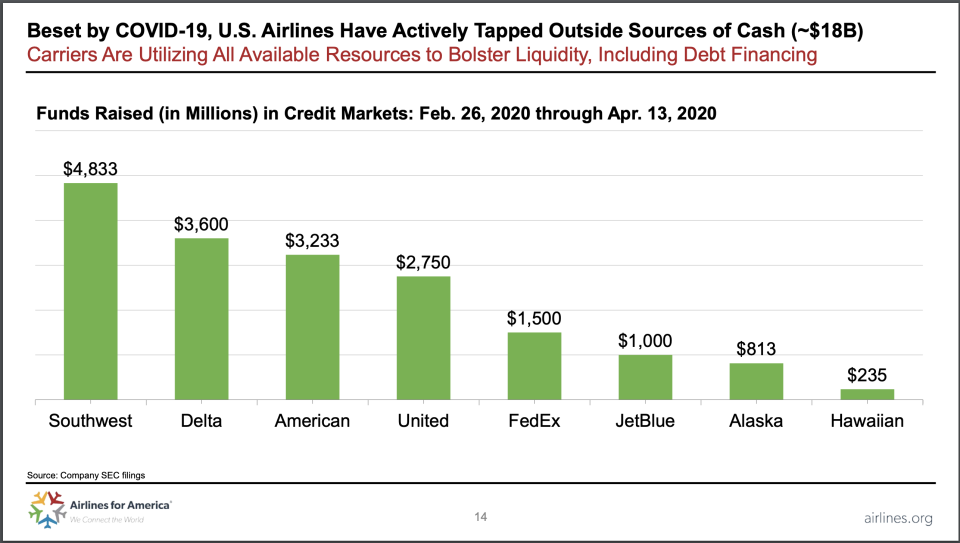

A4A says the major carriers have been able to finance billions of dollars in new credit in addition to the billions each of them will receive from the U.S. Treasury under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

United Airlines, April 30

United Airlines (UAL) is expected to report first quarter earnings on April 30. Documents filed with the SEC show the airline recorded a pre-tax loss of $2.1 billion, or a $1 billion pre-tax loss on an adjusted basis. Total revenues were $8 billion, a 17% decline year-over-year. United says it has $6.3 billion of cash, cash equivalents, short-term investments, and undrawn amounts, including $2 billion under its undrawn revolving credit facility.

United has secured $2.75 billion in new credit on top of the $5 billion it will get from U.S. taxpayers.

That includes a $3.5 billion direct grant to cover employee salaries through Sept. 30, while the other $1.5 billion is a low interest loan that allows the U.S. Treasury to purchase up to 4.6 million shares of the airline’s common stock.

“The challenge that lies ahead for United is bigger than any we have faced in our proud 94-year history,” CEO Oscar Munoz and President Scott Kirby told employees in an email last week. The payroll grant from taxpayers will not cover all of United’s payroll expenses, which amount to 30% of the airline’s total costs. Still, United, like others receiving the grants, has agreed to delay layoffs and furloughs through Sept. 30.

But Munoz and Kirby expect the airline’s business to continue to deteriorate and are planning to cut staff. “The challenging economic outlook means we have some tough decisions ahead as we plan for our airline, and our overall workforce, to be smaller than it is today, starting as early as Oct.1,” they told employees.

Looking toward May, the airline is warning investors that it expects to fly the same number of passengers during the entire month as it did in a single day in May of 2019.

“Travel demand is essentially zero and shows no sign of improving in the near-term. To help you understand how few people are flying in this environment, less than 200,000 people flew with us during the first two weeks of April this year, compared to more than 6 million during the same time in 2019,” which represents a 97% drop, according to Munoz and Kirby.

Delta Airlines, April 22

Delta Airlines (DAL) will report first quarter earnings April 22, and CEO Ed Bastian says the airline is taking vital steps to protect its future. “Since the pandemic began, we have taken down 80 percent of our schedule ... cut pay for officers and director-level employees; and gratefully accepted a remarkable 35,000 voluntary leaves of absence by Delta people,” Bastian told employees last week. Delta has also secured more than $3 billion in credit on top of the $5.4 billion it will get under the CARES act.

Of that amount, $1.6 billion is a 10-year loan that grants the U.S .Treasury warrants to purchase 1% of Delta stock over the next 5 years. The rest, almost $3.8 billion, is a grant to help cover salaries to keep Delta’s workforce paid through September.

Unlike United, Delta is not warning its employees to prepare for potential staff reductions.

“We still need volunteers to consider short- and long-term leaves of absence,” Bastian said. “You’ll continue to receive all of your benefits, and your job will be waiting for you when you return. So please think about whether a leave is right for you and your family — it is a vital part of our effort to safeguard Delta jobs.”

Southwest Airlines, April 28

Southwest Airlines (LUV), which is expected to report first quarter earnings on April 28, secured $4.8 billion in new credit while receiving $3.2 billion from the U.S. Treasury.

Most of that taxpayer money, $2.3 billion, is a direct payroll support grant that doesn’t have to be paid back. Another $1 billion is an unsecured 10-year loan covered by warrants that give the US Treasury the option to buy 2.6 million shares of Southwest.

The airline boasts it has never had an involuntary furlough in its 49-year history.

"We applaud the quick action by the U.S. Department of Treasury to infuse liquidity into the economy and try to keep businesses open and people on the job,” Southwest Chairman and CEO Gary Kelly said.

American Airlines, April 30

American Airlines (AAL) is getting the largest amount of taxpayer funds under the CARES act, $5.8 billion. American is expected to report earnings on April 30 but has not officially announced a date. In his email to American employees, CEO Doug Parker said $4.1 billion is a direct grant to cover employee salaries, and the remaining $1.7 billion is a low interest rate loan.

The airline’s 8-k filed with the SEC last week says the U.S. Treasury has warrants, “to purchase approximately 13.7 million shares of common stock of the company at a price of $12.51 per share.” American has also obtained $3.2 billion in new credit. Yet American is planning to request an additional $4.75 billion loan from the Treasury, according to Parker, who didn’t say why the additional funds are needed.

American, which operated 6,800 daily flights before the COVID-19 crisis, is navigating uncharted territory just like the other airlines. American has suspended 60% of its capacity this month and plans to reduce capacity in May 80% compared to the same period last year.

Still Parker tries to strike an optimistic tone in his message to employees, saying the CARES act grant “protects American’s team members from involuntary furloughs or pay rate reductions through Sept. 30, 2020, at which point demand for air travel will have hopefully recovered.”

Parker’s email to employees stresses: “We need to continue providing critical air service and safely serving those who need to travel. People who are flying today are doing so for important reasons, including medical professionals getting to where they are most needed and family members getting to where they feel most safe.”

It concludes by asking American’s employees to consider early retirement, reduced work, or paid leaves of absence, something 32,000 American employees have already taken.

Adam Shapiro is co-anchor of Yahoo Finance’s On the Move.

J&J eyes 'imminent' coronavirus vaccine production, aims for a billion doses worldwide

Gary Cohn: Restarting the economy after coronavirus is 'not going to be an overnight big bang'

Desperately needed medical supplies to fight coronavirus are now heading to US

Airlines plot course through turbulent coronavirus crisis with billions from US taxpayers

J&J's Chief Scientific Officer predicts vaccinations against coronavirus within 12 months

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit