Paramount Started Addressing Issues in Charter-Disney Dispute 7 Years Ago, CEO Says

- Oops!Something went wrong.Please try again later.

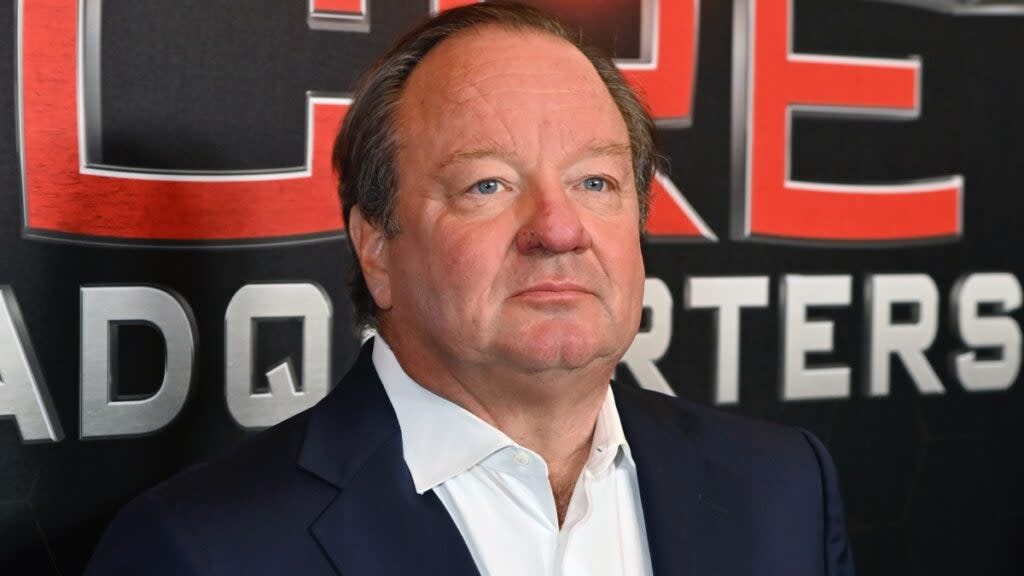

Though the roughly 15 million Spectrum subscribers who were left without access to Disney-owned channels may have been surprising to some people, Paramount Global president and CEO Bob Bakish isn’t one of them.

“When we saw this happen, this did not surprise us. We didn’t know it was going to happen Thursday night, but the fact that something like this would happen was not a surprise,” Bakish said at the Goldman Sachs Communacopia and Technology Conference.

“In fact, we started thinking about the evolution transformation of our company going back seven years, probably, and working with distributors in that regard to modernize the way we do business,” Bakish said.

The CEO used the hot topic as an opportunity to explain the myriad of ways Paramount has prepared for a possible breakdown between a major cable distributor. The executive initially pointed to the co-marketing agreements Paramount has with “every major distributor in the United States for streaming products,” referring to both Pluto TV and Paramount+ with Showtime. Bakish noted this collaborative agreement gives distributors an “incentive to transition and ride that migration of consumer behavior from traditional box linear to broadband.”

On the international front, Paramount has created bundles with non-American distributors such as the the U.K.-based Sky and the France-based Canal. “For us that means zero subscriber acquisition cost,” Bakish said. Though the head noted this model results in slightly less average revenue per user, it also provides Paramount’s international partners with “additional value for their subscribers.”

Bakish also highlighted partnering with Charter Spectrum skinny bundles like Spectrum TV Essentials. “We like that business. That has been a growing sector of the video ecosystem, the more attractively priced skinnier entertainment bundle,” Bakish said.

Finally, the executive highlighted one of the biggest ways the entertainment brand has diversified and optimized distribution: Paramount+ with Showtime.

“If you’re a consumer and you want that product on linear, you can get it that way,” Bakish said, referring to Showtime’s model that offers new content both on the streaming platform and linearly. Now no matter how a Showtime consumer subscribes to the platform, they have access to the channel both linearly and through the Paramount+ app.

“I think what’s important about that, for this conversation, is that we now have in place today multiple deals form the largest MVPDs [multichannel video programming distributors] and vMVPDs [virtual MVPDs] in the United States, whereby the linear Showtime subscriber, at the rebranding, will get access to app credentials,” Bakish said. “That is along the lines of what Charter was talking about.”

“I think that’s an example, taken with all the other ones, of how we’ve been working to transform our assets, strategy and relationships over many years to fit this changing consumer landscape. I would argue that not everyone is doing that,” Bakish added.

The failed negotiation between Charter Communications and Disney boiled down to cost and flexibility. Whereas Charter agreed to pay the higher premium for Disney-owned channels the company demanded, they also asked for more flexibility for subscribers to log into Disney-owned streaming services, such as Disney+ and Hulu.

Disney refused this deal but offered to extend negotiations so that Spectrum subscribers wouldn’t lose access to channels like ESPN and ABC ahead of Labor Day weekend, the first weekend of college football and the ongoing U.S. Open. This time, Charter refused. That’s why roughly 15 million Spectrum subscribers were left unable to watch any Disney-owned channels starting last Thursday. The blackout has already led to a class-action lawsuit.

The post Paramount Started Addressing Issues in Charter-Disney Dispute 7 Years Ago, CEO Says appeared first on TheWrap.