Nvidia’s Stock is Hitting Insane New Highs. It May Still Be a Buy.

"Hearst Magazines and Yahoo may earn commission or revenue on some items through these links."

Nvidia, the Silicon Valley semiconductor maker that suddenly is the third most valuable company in the world, is the stock where logic seemingly doesn’t apply. Its dramatic ascent from niche chip player to master of the tech universe has been nothing short of dizzying.

To appreciate the magnitude of this Nvidia mania and just how off-the-charts expensive its stock has become, consider these facts: It took Nvidia more than two decades to achieve a market valuation of $1 trillion, hitting that milestone in June of last year. The second trillion? A mere eight months. Nvidia’s shares have rocketed so high, at a recent price of some $791, that investors are paying a whopping $32 for every dollar of revenue Nvidia recorded last year. For context, the only two companies worth more than Nvidia—Microsoft and Apple—trade for about 13 and 7 times revenues, respectively. The fevered anticipation in advance of the company’s earnings report on Feb. 21 spawned social-media memes joking that the fate of the world depended on Nvidia beating expectations. It did, and the stock spiked higher.

So, naturally, Nvidia is wildly overvalued, and its current stock price makes no sense, right? Not necessarily.

For multiple reasons, the seeming illogic of Nvidia being worth $2 trillion—or even more—is quite logical, at least by the standards of technology growth companies that find themselves at the center of pivotal moments in the industry’s evolution. (The company’s value briefly topped $2 trillion on the second trading day after its explosive Feb. 21 earnings report; it since has slipped back to around $1.9 trillion.)

Understanding—and accepting—this requires investors to let go of traditional valuation metrics and embrace the unique opportunity Nvidia represents. That explains, anyway, the fascination with Nvidia’s stock on Wall Street and Main Street and why the company’s run could continue for quite some time.

Here are a few arguments for why the exuberance around Nvidia and its stock may be quite rational:

We’ve seen this movie before

Nvidia is not the first technology company whose stock has run away from what looks like reality. Way back in 1998, at the dawn of the dot-com era, a then little-known analyst named Henry Blodget slapped a $400 price target on an unprofitable online bookseller called Amazon.com, whose shares hadn’t previously traded above $243. It was an audacious prediction, one he predicated on the assumption that Amazon would move to much bigger markets than books. He was right. Amazon’s split-adjusted price back then was about $2, compared with a recent price of $177. When a singular company commands the fascination of Wall Street because of its dominant position in a key product, its stock can defy gravity. The same thing happened with Google when it first dominated search, to Apple when its iPhone redefined the market, and to Tesla when it effectively was the only game in electric cars.

Nvidia’s growth is red-hot

The company has been a tech darling for years, but its recent growth is next level. Revenues in 2023 more than doubled to $61 billion dollars, from an already robust $27 billion the year before. That kind of growth rarely happens at large companies, and it’s all because Nvidia makes the key chip needed by builders of artificial intelligence systems known as large language models. Without Nvidia there would be no ChatGPT or any of the other emerging generative AI products. Hence the torrid growth. The company’s profits have popped even faster than its sales, up ninefold in the fourth quarter, a sign Nvidia has been able to raise prices dramatically.

Its lead is immense

Nvidia is thought to have about 80% of the market for semiconductors that train key AI programs. That’s a stunning market position that has long-established chipmakers like Intel and AMD drooling for a piece of the action. The problem is that leading-edge chips take as much as a decade to develop. This isn’t like the apparel industry, where a scrappy competitor can introduce a lookalike later in the season. Investors are bidding up shares in Nvidia because they believe it has a lock on a critical market. What’s more, Nvidia has been an active investor in other companies, especially those that use its chips. The company has $26 billion in cash—twice the previous year—and a pricey stock with which to make more investments.

The market opportunity is massive

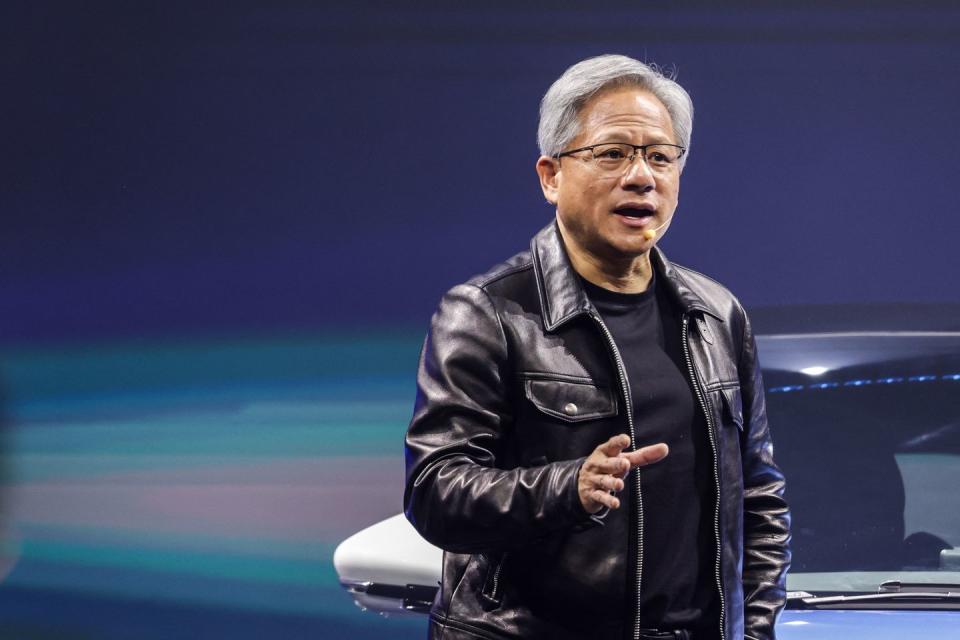

The enthusiasm for Nvidia also reflects the belief that generative AI—programs that spit back “thought-out” responses to queries that are far more sophisticated than mere Web-search results—represents a paradigm shift in how software works. That’s on top of applications promising to reorder sectors like automobiles, medical devices, and entertainment. “Accelerated computing and generative AI have hit the tipping point,” Nvidia founder and CEO Jensen Huang told investors when the company released its earnings. Bullish followers are even more ebullient. “We are in the very early innings of what we call the Mother of All Cycles,” Hans Mosesmann, a veteran semiconductor analyst, told his clients. Following the earnings report, Mosesmann upped his price target for Nvidia’s shares from $1,100 to $1,400, meaning he thinks Nvidia eventually could be worth $3.5 trillion.

No stock, especially one this expensive, is a sure thing. Like any crazy ride, bumps are to be expected, and Nvidia has known extreme volatility in the past. Several years ago, the company was generating significant revenue from bitcoin miners running its chips. When bitcoin fizzled, so did Nvidia’s stock, which dropped 65% in 11 months, beginning in late 2021. Just recently, with anticipation sky-high for the company’s coming earnings report, Nvidia’s share dropped 8% over several days—only to shoot up again after the news. That decline may not seem like much, unless you consider the company lost about $125 billion in market value.

Imagination, not logic, may be the most useful tool in predicting how high Nvidia might go.

You Might Also Like