BOE Rate Cut Expected to Be Pushed Back by Election and Inflation

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- This may be one meeting where the Bank of England is thankful the decision has been made for them. Prime Minister Rishi Sunak’s move three weeks ago to call an election has all but ruled out a rate cut when policymakers announce their decision at 12 p.m.

Most Read from Bloomberg

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

Hedge Fund Talent Schools Are Looking for the Perfect Trader

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

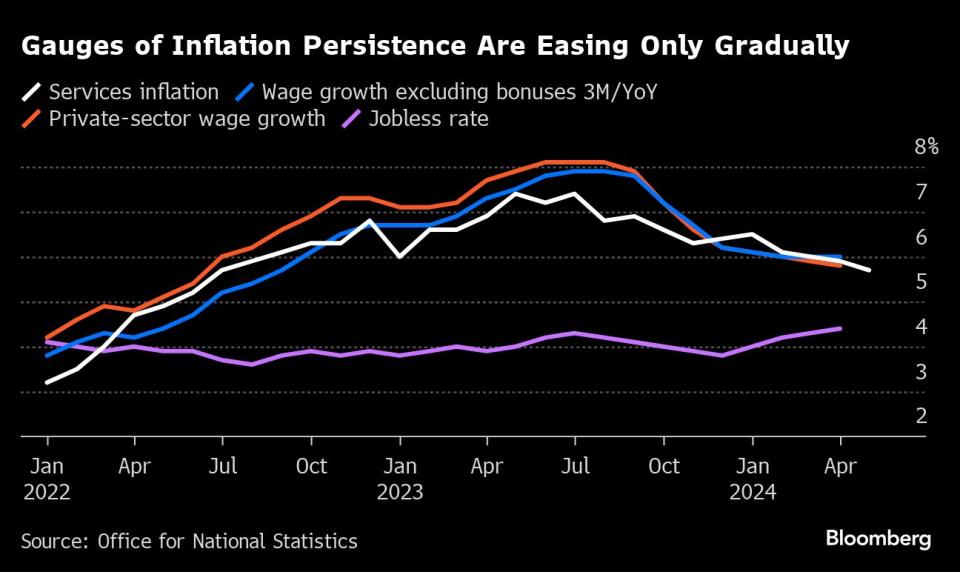

Inflation data on Wednesday only bolstered the case to wait a few more weeks to see which way price pressures are headed. While UK inflation slowed to the BOE’s 2% target for the first time in almost three years in May, price growth in the services sector remained almost triple that level. Investors and analysts expect Governor Andrew Bailey and his colleagues to leave the benchmark rate unchanged at a 16-year high of 5.25%.

Officials have remained silent during the run-up to the July 4 election to avoid the appearance of political interference, giving investors little insight on how to read the latest data. That means this decision will be especially carefully watched for signs of when officials might act and how BOE forecasts due in August are apt to evolve.

Here’s the key elements to watch in the decision:

Vote Split

The BOE’s nine-member Monetary Policy Committee split 7-2 on its decision to keep rates unchanged in May, with Dave Ramsden and Swati Dhingra voting for a quarter-point cut. Most economists expect a repeat of that decision, if only because there have been no speeches during the election campaign to provide any other guidance.

This is Deputy Governor Ben Broadbent’s final meeting, and Bloomberg Economics expects his replacement Clare Lombardelli to be more hawkish.

Forward Guidance

The BOE stepped away from its bias toward tightening rates in February and since has signaled that a move to lower rates is on the table if the data allows.

Bailey and Chief Economist Huw Pill have described rates now as “restrictive” and suggested that they would remain so even after the first cut. The question to them is how much restriction the UK economy needs to prevent a resurgence in price pressures.

Officials are watching wage growth and prices in the services sectors closely for signs of whether inflation will stay at the 2% aim. The suggestion is that once they’re more relaxed about those forces receding, they can ease off on monetary policy.

“We expect a policy summary that reaffirms a weak cutting bias, alongside continued spot data dependence,” said Benjamin Nabarro, chief UK economist at Citigroup. “The main question in our view is the extent to which the MPC choose to signal a move in August.”

What Bloomberg Economics Says

“Another stronger-than-expected services inflation reading will make for uncomfortable reading for the Bank of England and is likely to make it cautious about how quickly it eases monetary policy this year. We still think the fall in headline inflation to 2% warrants a cut over the summer – probably in August.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the PREVIEW.

Inflation and Growth

The BOE won’t release new forecasts until August, but it may comment on stronger-than-expected underlying price pressures since the last meeting.

While headline inflation fell to the central bank’s 2% target in May for the first time in almost three years, policymakers are still wary over strong increases in services prices. Inflation in the UK’s largest sector has not cooled as quickly as the BOE predicted in May.

The economy also ground to a halt in April after a 0.6% gain in the first quarter, with the BOE forecasting a lackluster 0.2% expansion over the second quarter. The outlook for 2025 and beyond has brightened, but some of that was pinned on interest-rate cuts that may now take longer to materialize.

Markets

Investors have backed away from expectations for sharp rate cuts this year after higher-than-expected inflation readings in the US and UK in the past few months.

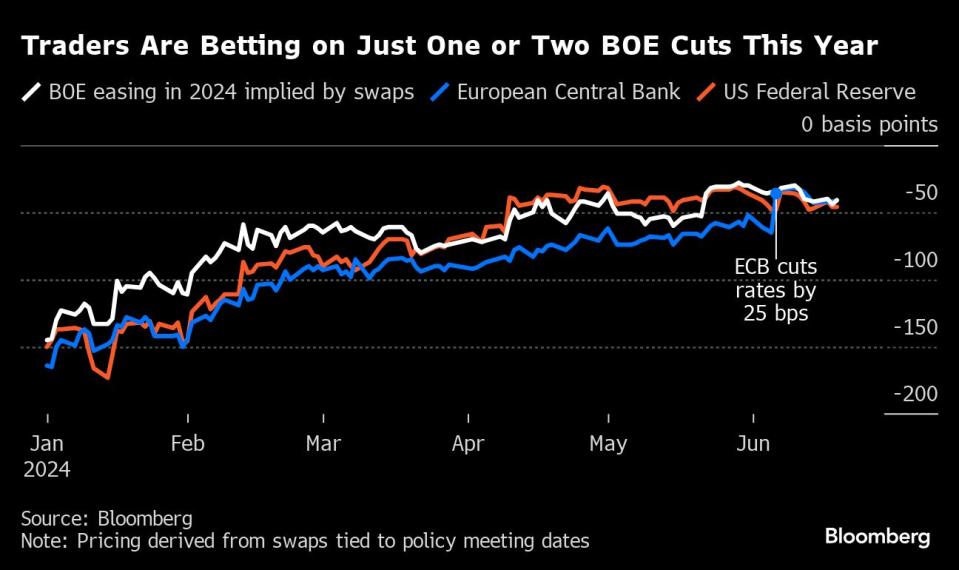

Traders have only one cut fully priced in for this year — down from as many as six at the start of the year — and aren’t convinced of the first move coming before November. However, there’s a 2-in-3 chance of a cut in September and economists believe the pivot could arrive earlier in August.

“Data have been clearly hawkish since the last meeting, which is reflected in markets pricing fewer rate cuts for 2024,” said George Moran, European economist at Nomura.

Quantitative Tightening

The BOE is reducing its balance sheet of government bonds built up under more than a decade of quantitative easing. The current pace of about £100 billion ($127 billion) a year — through both sales of the bonds and debt maturing — is now costing the UK Treasury under an indemnity where the government covers losses from the program, which is known as quantitative tightening.

The BOE is due to review the pace it is unwinding QE in September. It’s unlikely that policymakers will give any signal this month about potential changes with the election campaign running.

--With assistance from Andrew Atkinson and James Hirai.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.