French Banks Risk Causing Global Volatility as Key Lenders to the World

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- French banks, being among the largest lenders globally, risk contagion as political instability shines a light on the country’s finances.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

Nvidia Becomes World’s Most Valuable Company as AI Rally Steams Ahead

President Emmanuel Macron’s decision to hold snap legislative elections increases the risk of domestic economic volatility. Through the vector of France’s banks, it also risks global volatility.

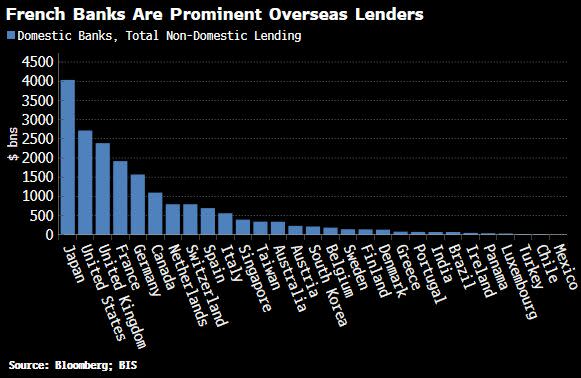

French domestic banks are the fourth biggest international lenders, after Japan, the US and the UK, with almost $2 trillion of foreign claims on their balance sheets, according to the Bank for International Settlements data.

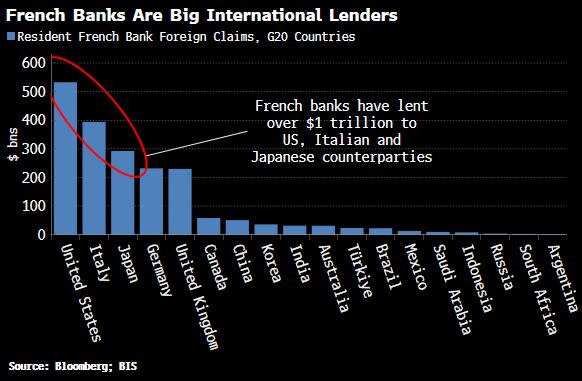

The banks of the UK, Japan, the US and Germany have lent the most to France, the UK lending $400 billion, and the rest about $200 billion each. On the other hand, the biggest debtor of the French banks is the US, with over $500 billion of loans, followed by Italy, Japan and Germany. The numbers are not insignificant, and could generate financial ripples beyond France if loans can’t be rolled or paid back.

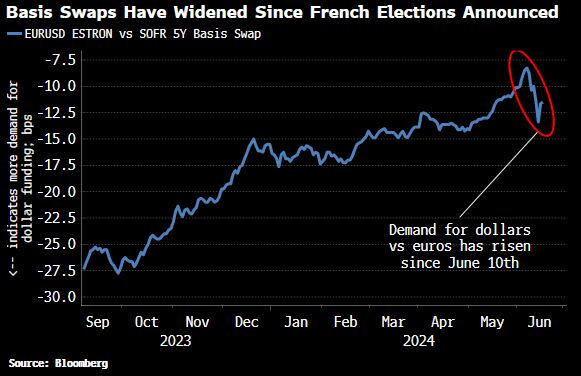

About half of French banks’ international loans are in local currency, i.e. euros, with the other half likely predominately in dollars. One place to keep an eye out for financial stress will be euro basis swaps. A basis swap is the discount on the short-term rate a lender of euros receives when borrowing dollars. These have widened somewhat since Macron announced the elections, indicating greater demand for dollar funding.

Is shorting the US dollar a smart strategy for second half? Share your views in the MLIV Pulse survey.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.