French Bond Premium Risks Hitting Danger Zone, Candriam CIO Says

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- The risk premium on French sovereign bonds is near to breaching a “dangerous” level that could signal a path to a financial crisis, warned Candriam’s chief investment officer.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

Nvidia Becomes World’s Most Valuable Company as AI Rally Steams Ahead

French bonds have slid since President Emmanuel Macron called a snap election, driving their yield premium over haven German debt to 79 basis points on Tuesday, the most since 2017. A higher close would take it to the most since 2012, when the euro-zone sovereign debt crisis was in full swing.

“The real question today is whether there’s a second wave and we are going to break 80 basis points, because if we break 80, we’ll be set for 100,” said Candriam’s Nicolas Forest, who oversees about €145 billion ($156 billion) of assets, in an interview. “If we break 80 it’s gonna hurt.”

Markets have taken fright at the prospect of Marine Le Pen’s far-right National Rally party winning the election, given it’s leading polls and she has previously pledged to cut taxes and increase spending. French Finance Minister Bruno Le Maire has warned the country would be plunged into a debt crisis similar to one sparked in the UK two years ago by Liz Truss if Le Pen were to implement her economic program.

Candriam sold some of its French debt holdings on June 11 and downgraded its call on European equities to neutral after the snap elections were announced, Forest said. While markets have stabilized somewhat this week after Le Pen’s assurances that she’d work with Macron, Forest sees no political scenario unfolding in which he would be a French bond buyer in the short run.

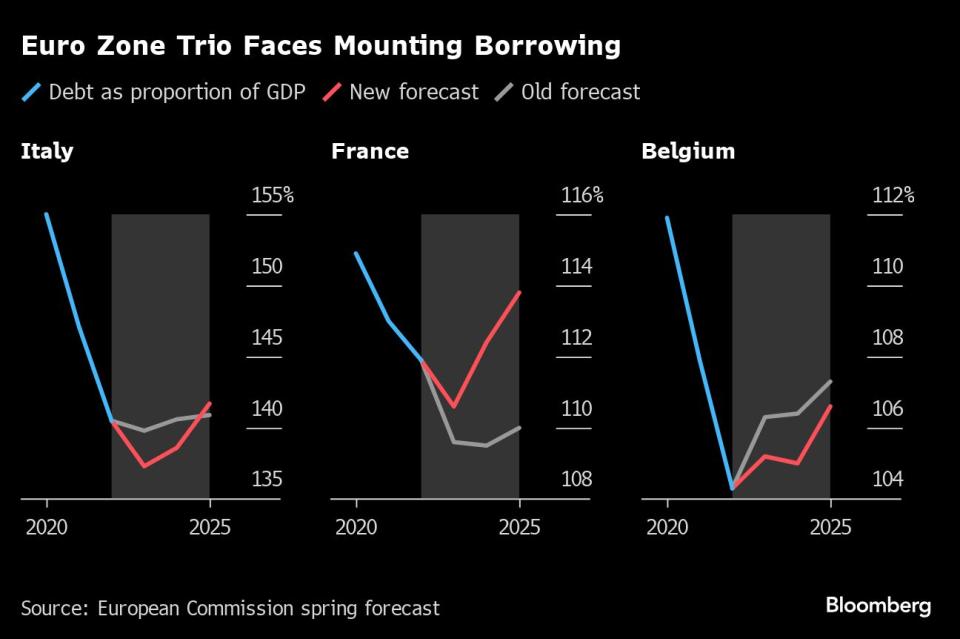

He said the longer term problem is that France becomes more like Italy, which together with Greece has typically had the highest levels of borrowing and riskiest bond market in the euro zone. France’s ratio of debt to gross domestic product is already expected to climb to more than 112% next year, versus above 138% for Italy.

“France is the sick man of Europe when it comes to deficits and debt,” Forest said, pointing to the European Commission being widely expected to launch a so-called ‘Excessive Deficit Procedure.’ “It’s not impossible that one day, and it might seem crazy what I’m saying, the French yield will be the equivalent of the Italian yield.”

At the moment 10-year French borrowing costs have climbed to around 3.20%, not far off the highest since 2011, though still about 70 basis points below the Italian equivalent. Markets watch the spread with German debt since that’s seen as the safest in Europe, so the extra yield investors demand for other nations is effectively a risk premium.

Forest said that given the euro-skeptic political platform of the far-right party, there was little hope of seeing a new government agreeing to curb spending significantly and find a deal with Brussels. A conflict with the European Union would also mean that the European Central Bank would not necessarily come to France’s rescue.

“In the history of sovereign debts, there are not only happy endings,” Forest said. “The French elections are a Damocles sword.”

--With assistance from James Hirai and William Horobin.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.