Mexico Peso Falls as Ruling Party Landslide Spooks Investors

(Bloomberg) -- Mexican assets tumbled after preliminary election results showed the ruling party winning in a landslide that may empower it to increase state control of the economy and undermine checks on its power.

Most Read from Bloomberg

Modi Vows to Retain Power Even as Party Loses India Majority

Short Sellers in Danger of Extinction After Crushing Stock Gains

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Treasuries Gain as JOLTS Spurs Faster Fed-Cut Bets: Markets Wrap

Intel CEO Takes Aim at Nvidia in Fight for AI Chip Dominance

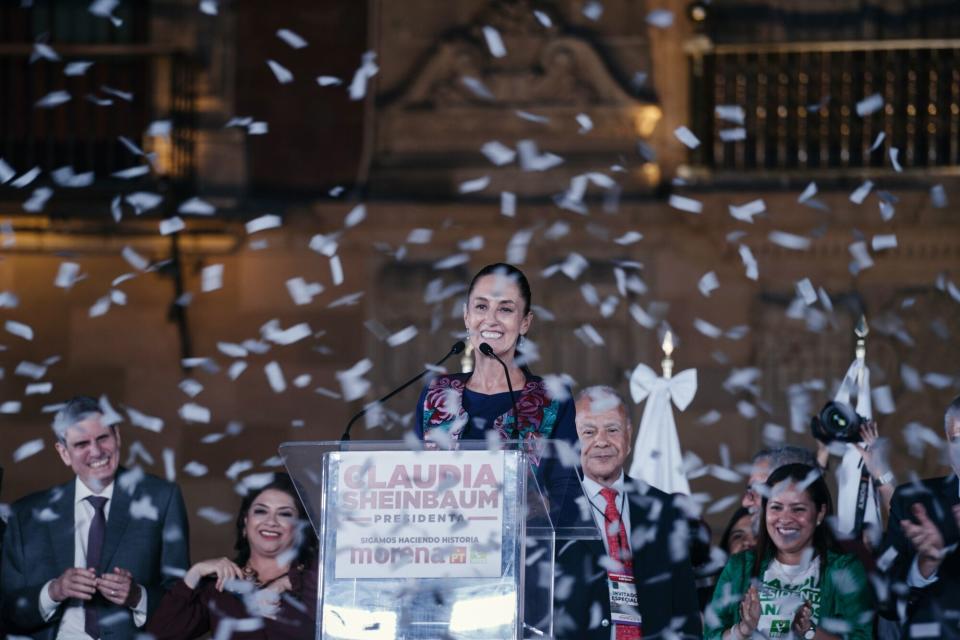

The peso led global losses, sinking more than 4% and heading for its worst one-day loss since June 2020, while stocks headed for their biggest slump since the 2008 financial crisis. Swap rates climbed. Official projections showed Claudia Sheinbaum, the protege of President Andres Manuel Lopez Obrador, winning by at least 30 percentage points.

Read More: Sheinbaum Set to Become Mexico’s First Female President

While her win was largely priced in, the quick count published by the electoral authority also pointed to the ruling Morena party and its allies winning a so-called supermajority in the lower house and clinching at least a simple majority in the Senate — more support than polls suggested. Investors were closely eyeing the congressional races as a two-thirds majority would give the ruling coalition a mandate to pass more ambitious reforms that could change the constitution.

“The potential for a supermajority does cause some concern as it could erode Mexico’s fiscal prudence seen during most of AMLO’s administration,” said Guido Chamorro, senior portfolio manager at Pictet Asset Management in London, referring to Lopez Obrador. “There is a question about how fiscally conservative Sheinbaum will be.”

Reforms

The congressional results will determine if Morena will be in the position to pass a swath of proposals made by Lopez Obrador in February. Those bills include plans to reduce the number of lawmakers and allow for the direct election of Supreme Court justices. They also include eliminating independent regulators, like the antitrust commission, as well as establishing new pension obligations and mandatory minimum wage hikes.

Such an outcome could sap appetite for Mexico assets, including the peso, which has been one of the top performing major currencies this year against the dollar. The peso has defied calls that it’s overvalued and continued to rise, with Mexico’s close ties with the US shielding the currency from the strong dollar that has roiled other developing nations. It’s also been supported by a hawkish central bank that has been the slowest in Latin America to lower borrowing costs.

Read More: Traders Caught Off Guard as Sweep in Mexico Vote Tanks Peso

The iShares MSCI Mexico ETF (EWW), the biggest US exchange traded fund tracking Mexican equities, fell more than 10% Monday, the most intraday since March 2020. EWW has seen over 7.5 million shares traded as of 2:37 p.m. in New York, more than any full day since 2019, data compiled by Bloomberg show.

Mexico’s benchmark stock index sank nearly 7%, putting it on track to post its worst single day loss since October 2008. Banking stocks led the losses as the prospect of a Morena majority raised concerns the party could seek to force banks to lower fees, as it has in the past, or pay more taxes. Grupo Financiero Banorte, the biggest Mexican—owned bank, sank over 15%.

“We believe the financial sector could bear the brunt of these heightened legislative risks either through taxation or industry-specific measures,” Bradesco BBI strategist Rodolfo Ramos wrote in a note.

Read More: Mexican Banks Tumble on AMLO’s Surprise Proposal to Limit Fees

If the next government and Congress adopt an unorthodox agenda that undermines Mexican institutions, the peso would weaken to 19.20 per US dollar, Morgan Stanley analysts said in an April note. Barclays strategists saw odds the peso would see a 4% plunge if Morena were to win a constitutional majority that would lead to a more leftist radical reform agenda, they wrote in a note ahead of the election, while adding that chances of that were small.

“The possibility of a supermajority in congress would be a material game changer for Mexico,” said Gordian Kemen, head of emerging-market sovereign strategy at Standard Chartered Bank. “I can see the market getting concerned about energy policy, fiscal stance, but also monetary policy.”

‘Super peso’

The peso has also been the best performing major currency over the last six years, during Lopez Obrador’s term, flying in the face of concerns that his policies would spark a deep devaluation. His government bucked expectations for higher spending and instead maintained fiscal discipline that set it apart from other economies, whose deficits blew out during the pandemic. However, Lopez Obrador ramped up spending this year, leaving the challenge to Sheinbaum to rein it back in.

Sheinbaum’s double-digit lead in the months ahead of the election had helped keep the peso steady on an expectation of continuity. Investors have seen Sheinbaum providing stability in Latin America’s second-largest economy with the potential that she takes a more market-friendly tack than Lopez Obrador, who couldn’t seek another term.

Read More: AMLO Looms Over His Protege’s Path to Historic Victory in Mexico

Analysts at Morgan Stanley projected there was a chance that Sheinbaum could be more open to private investment in the power sector and take measures to draw more factories to Mexico in the trend called nearshoring.

In her first speech as president-elect, Sheinbaum pledged to respect central bank autonomy and fiscal discipline, calling for more investment in renewable energy and promising to promote foreign investment.

The strong carry appeal for the currency should continue to provide some support for the Mexican peso, potentially making any selloffs transitory, said Claudia Ceja, a strategist at BBVA Mexico.

Mexico’s long transition period — the new Congress won’t take office until September, while Sheinbaum will be inaugurated in October — also means it will take some time to see if investors’ initial concerns play out.

That also leaves space for Congress to approve some of Lopez Obrador’s proposed reforms before Sheinbaum’s first day in office, said Gabriel Casillas, chief Latin America economist at Barclays.

“This is not what market participants were expecting,” Casillas said. “We could see a further adjustment of asset prices to reflect this apparent new reality.”

--With assistance from Selcuk Gokoluk, Maria Elena Vizcaino, Carolina Wilson, Matthew Burgess, Colleen Goko and Philip Sanders.

(Updates market prices from second paragraph and adds strategist comment in the ninth.)

Most Read from Bloomberg Businessweek

The Budget Geeks Who Helped Solve an American Economic Puzzle

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

Disney Is Banking On Sequels to Help Get Pixar Back on Track

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.