South Africa’s ANC Braces for Rival Talks as Majority Crumbles

(Bloomberg) -- South Africa’s ruling party is girding for grueling talks with bitter rivals over the makeup a new government, after losing a parliamentary majority that’s stood for 30 years.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

GameStop Shares Surge as Gill’s Reddit Return Shows Huge Bet

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

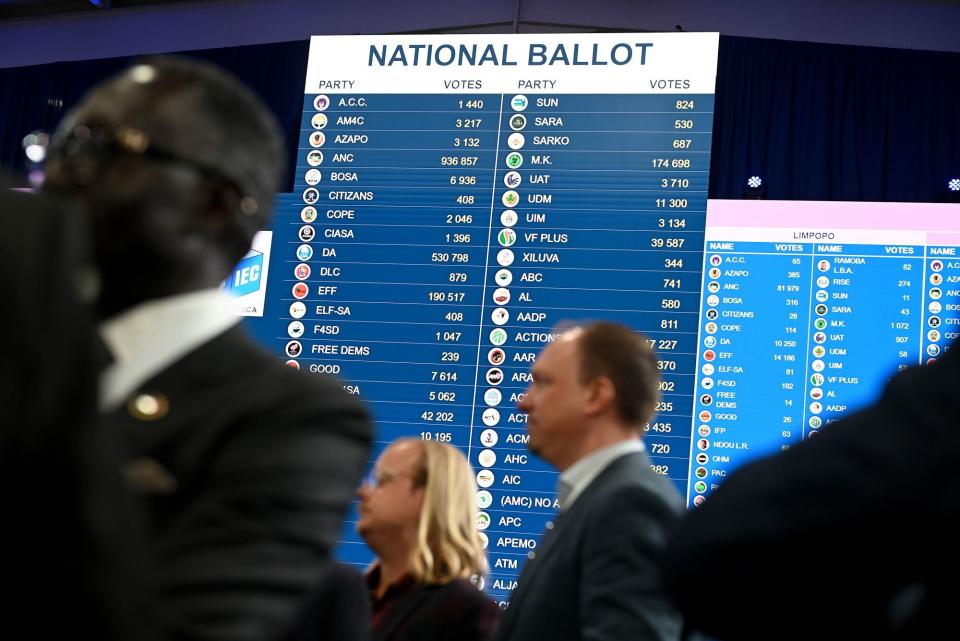

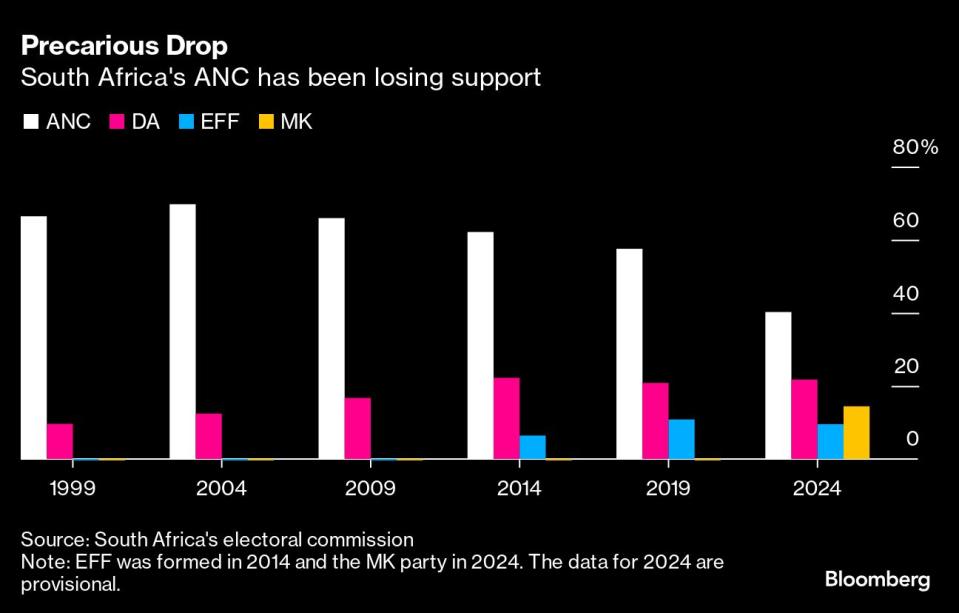

With ballots from 99.9% of voting districts counted in the May 29 election, the African National Congress got a 40.2% share, down from 57.5% in 2019 as voters dealt a historic rebuke to the party Nelson Mandela led to power at the end of apartheid. The main opposition Democratic Alliance secured 21.8%, while a party led by former President Jacob Zuma seized 14.6% just five months after its launch.

The ANC’s slump comes after years of economic mismanagement and corruption damaged water and power supplies and unemployment running above 30%. The electoral shake-up has pushed Africa’s most-industrialized nation into uncharted territory, and prompted key leaders of the ANC, DA and others to consider a coalition.

“The ANC has been in power for too long and has been too complacent,” William Gumede, a political analyst and founder of the Democracy Works Foundation, said in an interview with Bloomberg Television. “I think now for the first time since 1994 we will actually see some kind of accountability, some kind of urgency to deal with all these structural issues.”

The country’s Electoral Commission says it will officially announce the results on Sunday evening, notwithstanding Zuma’s demand that they delay to review allegations of voter irregularity made by his party and some others.

Under the constitution, South Africa’s National Assembly must convene within 14 days to elect a speaker and a president after the declaration of the election outcome.

Read more: Zuma Doubles Down on South Africa Vote Discrepancy Claims

The extent of its loss leaves the ANC with the choice of turning to the DA or seeking an alliance on the left with either Zuma’s uMkhonto weSizwe Party, known as the MKP, or the populist Economic Freedom Fighters.

The future of President Cyril Ramaphosa is also in question, six years after he ousted Zuma to end a scandal-tainted tenure.

Bloomberg Terminal clients can click on ELEC ZA for more on South Africa’s elections.

DA leaders are leaning toward seeking a formal coalition with the ANC in which they would receive some cabinet posts and control of several parliamentary portfolio committees, according to people familiar with the matter who asked not to be identified as the talks aren’t public. Some DA leaders oppose the idea, the people said, and a decision has yet to be taken.

The DA’s top leadership is scheduled to meet on Sunday to discuss its approach toward coalitions. The Inkatha Freedom Party, a minor conservative group, has also organized a gathering of its national executive committee for Sunday morning. Those summits will inform the ANC’s own discussions on the topic that are expected to start early next week.

Read More: What Next for South Africa After Seismic Election?: QuickTake

“At this stage the party hasn’t worked out what the approach should be,” DA national spokesman Solly Malatsi said in an interview on Saturday at the election results center near Johannesburg. “By the end of tomorrow, we will have a sense of the approach for coalitions and who we can start initiating prospective talks with.”

ANC Chairman Gwede Mantashe has said the party won’t comment on coalition talks until the final results are declared.

If the ANC chooses to form a minority government, it will still need the support of a rival to appoint a president as that position is voted on by parliament.

For financial markets, the ANC’s choice of partner is key, as both the MKP and EFF have demanded that everything from land to banks be nationalized. The prospect of them joining the government has spurred a sell-off in the rand and nation’s bonds, with the risk of the investor exodus accelerating if such an alliance was formalized.

Read More: South Africa’s Shock Election Imperils Business-Driven Reforms

A tie-up with the DA would likely accelerate economic reforms and privatization initiatives that Ramaphosa had begun to put in place.

“It’s pretty binary,” said Martin Kingston, chairman of the local unit of Rothschild & Co. “That is best- and worst-case scenarios for business.”

Ramaphosa’s allies prefer an investor-favored pact with the business-friendly DA which would keep him at the helm, according to people familiar with the situation. Some of his detractors in the party favor linking up with EFF and MKP, which could see Ramaphosa ousted or resign.

EFF leader Julius Malema, who established the party in 2013 after he was expelled from the ANC, said he’s open to cooperating with his former party.

“We want to work with the ANC,” he told reporters Saturday. “If there is any party that we can work with, and work with properly, it is the ANC.”

The MKP said it’s considering calling for a rerun of the vote over alleged irregularities and is taking legal advice on the matter.

If Ramaphosa does step down, that would represent a victory for Zuma, who was fired as deputy president in 2005 amid corruption allegations, won control of the ANC in 2007 and led the country for almost nine years before being ousted by his own party and replaced by Ramaphosa in 2018.

Since then, he’s been fighting a legal battle against charges of taking bribes to facilitate an arms deal in the 1990s and served time in jail after refusing to testify before a judicial inquiry into state graft. His imprisonment in 2021 triggered the worst riots in South Africa since the end of White-minority rule, leaving 354 people dead.

The MKP won 45.4% of the ballot in KwaZulu-Natal, Zuma’s home province and the second-most populous in South Africa. The ANC saw its support there plunge to 17% from 54.2% in 2019. The DA retained its majority in the Western Cape province — famed for tourist mecca Cape Town, wine farms and gangs — which it has ruled since 2009.

Sign up here for the twice-weekly Next Africa newsletter

--With assistance from Monique Vanek, Mpho Hlakudi, Ntando Thukwana, Paul Vecchiatto, Mike Cohen, Arijit Ghosh, Loni Prinsloo and Alister Bull.

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.