Thai Government Eyes Tighter Grip on Central Bank After Spat

(Bloomberg) -- Thai Prime Minister Srettha Thavisin’s administration is discussing ways to exert more control over the country’s central bank after repeatedly clashing with the monetary authority on economic policy, according to people familiar with the matter.

Most Read from Bloomberg

Billionaire-Friendly Modi Is Punished by Millions of Poor Voters

S&P 500 Hits 25th Record This Year as Tech Soars: Markets Wrap

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

One of the measures under discussion focuses on the Bank of Thailand’s board chairman role, which will open up in September, the people said. While the chairman doesn’t have powers to dictate monetary policy, the official can evaluate the BOT governor’s performance as well as have a say in which outside experts join the Monetary Policy Committee.

Kittiratt Na-Ranong, a former finance minister-turned-adviser to Srettha, and Supavud Saicheua, an outspoken critic of the central bank and former adviser to ruling Pheu Thai party, are among those in consideration for the BOT chairman’s job, the people said, requesting anonymity as the discussions are private.

Porametee Vimolsiri, who completes his term as head of the BOT board in September, was appointed by the erstwhile military-led establishment, which also picked the current Governor Sethaput Suthiwartnaruep. The BOT’s seven-member MPC comprises three central bank officials, including the governor, and four external members.

When Sethaput’s term ends in September 2025, the government will push for a new governor who is likely to be more sympathetic and aligned with its views, the people said. Srettha’s administration will have a say in who succeeds him, with the finance minister tasked with appointing a search committee.

Thai government spokesman Chai Wacharonke said he couldn’t comment on the issue as he wasn’t aware of the move, while a BOT representative declined to comment. Kittiratt and Supavud didn’t respond to phone calls and text messages seeking comments.

The baht fell as much as 0.3% on the news and was at 36.715 to a dollar by 5:49 p.m. local time. The key stock index extended gains to as much as 0.5% before closing little changed, while a gauge of finance and securities firms ended 1% higher.

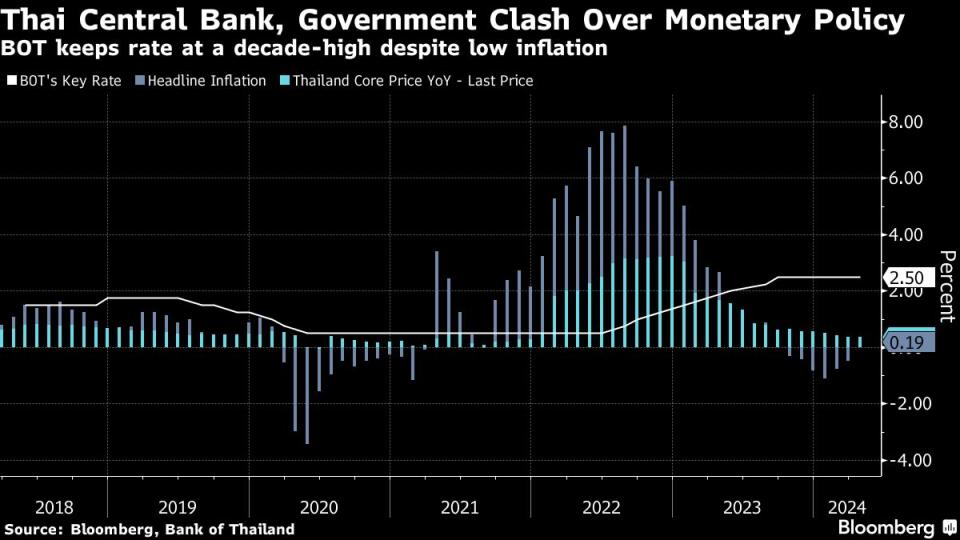

The discussions on gaining more influence over the central bank follow growing differences between Srettha and Sethaput on approaches to revive the $500 billion economy, which has grown an average 1.9% in the past decade — a pace far slower than its regional peers. While the government has favored cutting rates from a decade-high 2.5% to boost consumption and growth, the central bank has instead advocated structural reforms to aid the economy.

The disagreement prompted Paetongtarn Shinawatra, former premier Thaksin Shinawatra’s daughter and head of Pheu Thai party, to publicly blame the BOT’s autonomy as an “obstacle” to revitalizing Southeast Asia’s second-largest economy. Within weeks, Finance Minister Pichai Chunhavajira called for a review of the BOT’s inflation target, saying it needs to reflect current economic conditions — which the people familiar said was a pressure tactic to get the BOT to adjust monetary policy.

This is not the first time that a ruling party linked to Thaksin has clashed with the central bank. In 2001, Thaksin fired the then BOT governor after the official defied his call for interest rate adjustments. In 2013, Kittiratt, who who was finance minister in Yingluck Shinawatra’s cabinet, had publicly pressured the then central bank head Prasarn Trairatvorakul to cut rates.

The latest dispute has weighed on Thailand’s financial markets with foreign investors offloading the nation’s currency and equities. Global funds have pulled out more than $3 billion from local stocks and bonds so far this year, while the baht is among the biggest losers during the period, in part due to the dollar’s strength.

The move to gain control over BOT poses the risk of the government losing longer-term advantages from distancing itself from central bank rate decisions, said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank in Singapore.

“And the advantages gained from lower policy rates will be more than offset by surging risk premium and currency depreciation,” Varathan said. “Central bank independence is not just good for the BOT and the baht, but for the government too.”

Sethaput and his team have so far resisted political pressures, with Deputy Governor Alisara Mahasandana last week defending the BOT’s 1%-3% inflation goal as “appropriate,” although price gains have been well below the floor of its target range for 12 straight months.

What Bloomberg Economics Says...

The move could be the last straw for investors worried about political interference in monetary policy. The finance ministry is already considering raising the Bank of Thailand’s 1%-3% inflation target – an escalation of government efforts to coerce it into delivering the rate cuts it wants to stimulate near-term growth. If either are implemented, we’d expect capital outflows to pickup, including the more critical foreign direct investment.

— Tamara Mast Henderson, Asean economist

BOT is expected to keep the policy rate steady for a fourth straight meeting on June 12, with economists including from Goldman Sachs Group Inc. and CIMB Group Holdings Bhd pushing back their calls for rate cut to later this year or to 2025.

Fiscal Push

Under BOT’s rules, the chairman and MPC members are appointed for a three-year term and eligible for reappointment for a maximum of six years. While the current chair Porametee is serving his second term, the outside members of MPC will complete their term in October 2026.

The market will be closely watching how far the government follows through with its BOT plans, according to Lavanya Venkateswaran an economist at Oversea-Chinese Banking Corp. in Singapore. “That said, even perceived risks to undermine BOT’s decision-making processes will be viewed negatively by policy watchers and market participants,” she said.

In the absence of monetary policy support, the government is pressing ahead with fiscal measures to stimulate the economy, including an about $14 billion digital wallet program to handout 10,000 baht ($273) in cash each to some 50 million adult Thais for them to spend on a range of goods and services.

But rising political uncertainty with Srettha and Thaksin facing legal scrutiny in separate cases has cast a shadow over the government’s plans to revive the economy. Citigroup Inc. and Nomura Holdings Inc. said last week the handout is at risk of being derailed by the political turmoil.

Srettha’s aides have also sought to pile pressure on the BOT by demanding that the central bank take steps to lower the net interest margin charged by commercial lenders. The premier is also weighing shifting banking regulatory powers from the BOT to a new agency as part of an overhaul of the civil service, Thai-language newspaper Krungthep Turakij reported in May.

The finance ministry has also floated the idea of shifting about 570 billion baht of liability on the government account — incurred from bailing out financial institutions after the Asian financial crisis — to the central bank. Such a move will lower the ratio of public debt-to-GDP, currently capped at 70%, and allow the government to borrow more and stimulate the economy.

--With assistance from Anuchit Nguyen, Patpicha Tanakasempipat and Marcus Wong.

(Updates with market performance in seventh paragraph.)

Most Read from Bloomberg Businessweek

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

©2024 Bloomberg L.P.