World’s Rich Caught in Crossfire of Britain’s Election Battle

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Britain’s politicians are homing in on benefits that have long been offered to some of the nation’s richest residents, weighing whether a tax sting on the upper echelons will help boost them in the polls.

Most Read from Bloomberg

Ukraine to Get 155mm Artillery Shells Found in Czech-Led Effort

Return-to-Work Policies Devolve Into a Toxic Cultural Flashpoint

Crafts Retailer Joann Is Planning a Bankruptcy Filing That Would Hand Keys to Lenders

Property Tycoon Accused of Embezzling $12 Billion in Vietnam’s Biggest Fraud Case

Chancellor Jeremy Hunt is weighing scrapping preferential tax treatment for rich foreigners in Britain as he seeks to fund pre-election giveaways, a person familiar with the matter has said this week. Labour have already said they would overhaul the rules if they win as expected this year.

Any change for “non-doms” – UK residents whose permanent home is in another country — would follow two major reforms in the past two decades and underscore the challenges wealthy individuals are facing, whoever wins power.

“The boat’s been wobbling for a couple of years,” Mark Davies, a tax adviser for the super-wealthy, said on the non-dom policies. “I think it’s starting to sink.”

Read more: Hunt Weighs Ending Non-Dom Tax Status to Raise Budget Funds

Non-domiciled residents — ranging from multibillionaires to middle-ranking bankers — don’t pay UK taxes on their overseas earnings for as long as 15 years under the current program, introduced by the ruling Conservative Party. They can initially claim the status without any extra charges, but eventually face annual costs of as much as £60,000 if they continue to reside in Britain.

The Labour Party estimate they can raise about £3 billion ($3.8 billion) if they were to scrap the status altogether. Their latest plan, trailed last month, is to consult on a new system with shorter timescales.

The UK’s non-dom regime dates back to 1799, when it was introduced to protect colonial investments. Defenders say the system attracts entrepreneurs who create companies and jobs. But the status is under particular scrutiny in the wake of a record squeeze on living standards for ordinary Britons.

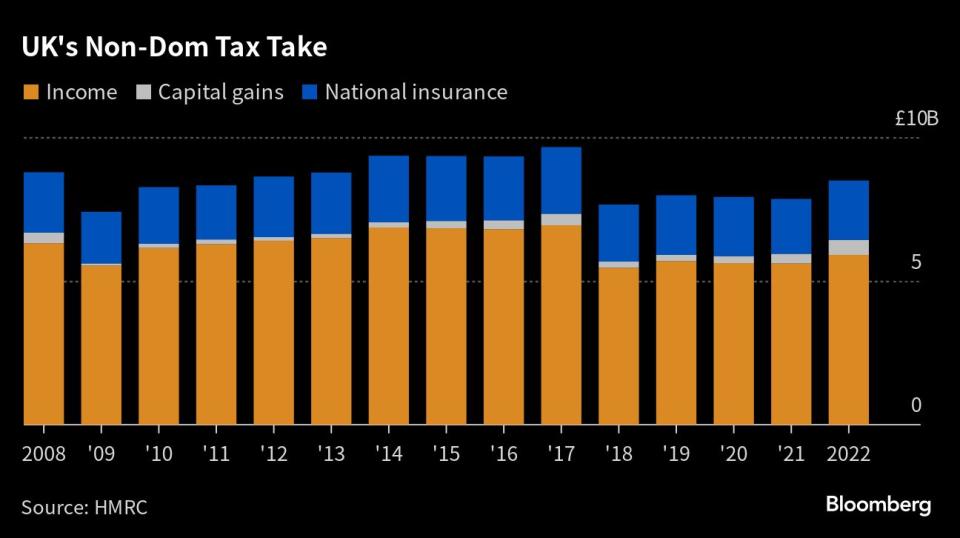

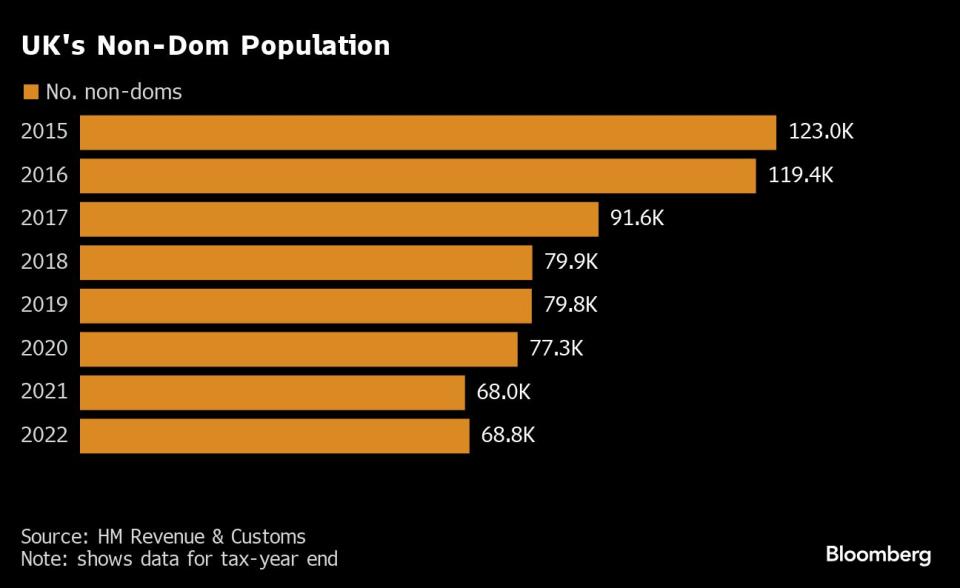

The number of people claiming non-dom status has already been in decline for the past decade after a change in the rules to stop individuals using the benefit permanently — a reform first proposed by Labour under Ed Miliband’s leadership, and later implemented by the Tories. There are now 68,800, who contributed £8.5 billion through income, capital gains and employment taxes in the year through March 2022.

In recent years, notable non-doms have included former HSBC Holdings Plc Chief Executive Officer Stuart Gulliver and onetime Conservative Party Deputy Chairman Michael Ashcroft.

Prime Minister Rishi Sunak’s wife, Akshata Murty, was also revealed in 2022 to benefit from the status, denting the then-chancellor’s approval ratings. After a media storm, Murty said she would pay UK taxes on her global earnings, partly derived from Indian software giant Infosys Ltd.

David Lesperance, a Poland-based tax and immigration adviser for the ultra-rich, said the rate of ultra-high-net worth individuals quitting the UK will rapidly rise if the non-dom route is cut off completely.

It’s an “already steady stream” of emigration, Lesperance said. It “will become a stampede.”

Any rule shift would cause particular angst in the City of London. More than one in five of the UK’s best-paid bankers have claimed the status, according to 2022 research from the London School of Economics and the University of Warwick.

About 22% of bankers earning more than £125,000 claimed non-dom status at some point, the researchers found. A recruiter for hedge funds said the removal of the status would seriously damage London’s appeal, while a City lawyer said it would be a foolhardy move that could drive away the internationally mobile community. Neither wanted to be named discussing the changes.

Other industries with high proportions of non-doms — although lower absolute numbers than the City — include the oil industry, where two out of five top earners had claimed it, and the car industry, where a quarter have claimed. One in six top-earning sports and film stars living in the UK have used this status, the LSE and Warwick found.

“Clients say ‘I love living in London,’ but there is a cost of doing so at which you say this is unacceptable,” added Davies, the tax adviser. “There is a sense that cost is going over a tipping point.”

Monaco option

The very wealthiest in Britain have numerous options to relocate if they want to avoid tax changes or other policies they see as unfavorable. Jim Ratcliffe, the 71-year-old founder of chemicals conglomerate Ineos, has said the prospect of avowed socialist Jeremy Corbyn winning power in the 2019 election was a factor in his relocation in around 2018 to Monaco, where residents don’t face income or capital gains taxes. He’s the UK’s second-richest person with a net worth of $17.6 billion, according to the Bloomberg Billionaires Index.

Ineos’s two other major shareholders — finance director John Reece, who turns 67 this month, and 68-year-old director Andy Currie — were both listed as living in Monaco in a 2019 US filing. They have a combined net worth of about $11 billion.

Monaco remains a popular destination in contingency plans for wealthy individuals exploring leaving Britain. Other territories include Dubai, Greece and Italy, which has seen a recent boom in wealthy foreigners moving to Milan for its own non-dom regime styled on the UK’s system.

“Many would expect the changes to be negative for the exchequer,” Dominic Lawrance, a London-based partner at global law firm Charles Russell Speechlys, said on Hunt possibly scrapping non-dom status. “The concern is that the UK’s loss will be Italy’s gain.”

--With assistance from Tom Rees, Joe Mayes, Charlie Wells, Nishant Kumar and William Shaw.

Most Read from Bloomberg Businessweek

The Monaco Royals Whose Deals Have Brought Peril to the Palace Doors

Top Takeaways From Businessweek’s Investigation Into Monaco’s Royal Family

China’s Piano Dreams Are Fading for a Cash-Strapped Middle Class

©2024 Bloomberg L.P.