Jensen Huang's Nvidia sure hopes the AI bubble doesn't burst anytime soon

- Oops!Something went wrong.Please try again later.

Jensen Huang is on top of the world.

The AI frenzy briefly made his company, Nvidia, the most valuable in the world this week.

Its future growth hinges on generative AI succeeding.

It's been a week to remember for Jensen Huang.

The 61-year-old CEO of Nvidia watched as his company briefly surpassed Microsoft to become the world's most valuable company for the first time with a $3.34 trillion valuation.

Though Nvidia has since slipped behind Microsoft again, with Apple now breathing down its neck too, its position among two titans of American tech battling for the bragging rights at the top spot is a sign of just how far it has come.

No longer is Huang's company — once on the brink of bankruptcy in the 1990s — just a purveyor of niche graphics cards designed for the gaming industry, but a near-indispensable component of the generative AI boom.

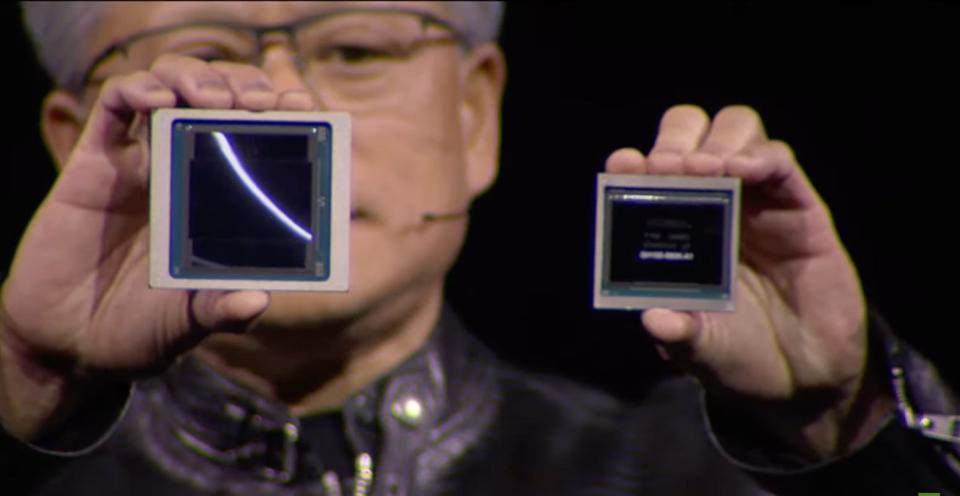

Nvidia's chips, known as GPUs, have been the subject of hot demand from the likes of Meta, Google, and OpenAI as they've sought to get their hands on hardware that can help them train and build increasingly powerful AI models.

Last month, the company showed just how relentless demand has been when announcing results for the first quarter of its fiscal year: it set a record quarterly revenue of $26 billion, up from 18% the previous quarter and 262% from the same quarter a year ago.

It helps explain why the frenzy around Nvidia has been reminiscent of the stock market rally during the dot-com boom.

The company has not only left its roughly $400 billion valuation from January 2023 in the dust, but is now worth about as much as the 100 biggest companies on the UK stock market.

The question now is how long will it last.

AI forever?

For the bulls, Nvidia's rally still has plenty of room to run.

Since the launch of ChatGPT, the most optimistic proponents of the generative AI boom — driven forward by Nvidias H100 GPUs — have made the case that we are still in the beginning stages of a revolution that has the potential to be as influential as smartphones and the internet.

In a research note on Thursday, analysts at Wedbush including Dan Ives, who has called Nvidia's CEO the "Godfather of AI," wrote that "the AI party is just getting started as its 9 p.m. in a party going till 4 a.m. with the rest of the tech world now joining."

Huang has done his own bit to make the case for AI mania just getting started, too.

Speaking in Taipei this month, the Nvidia boss boldly claimed that "the intersection of AI and accelerated computing is set to redefine the future" and laid out a road map for releasing upgraded chips every year to help achieve this future.

In other words, Huang suggests that companies engaged in fierce competition to make generative AI smarter will do so by working closely with a company like Nvidia, which can give them the computing power they need.

Boom or bust?

Nvidia's position as the primary provider of that computing power has been helped by its CUDA software, which has made it easy for companies to use their GPUs — no matter how varied or complex their AI is.

However, Nvidia's run faces one big risk: it depends on the generative AI boom lasting. That's a bet facing considerable uncertainty for a few reasons.

Though tech giants, including Apple, Google, Meta, and Microsoft, now appear to have made generative AI their priority, there appears to be awareness of the technology's weaknesses.

Earlier this month, for instance, Apple CEO Tim Cook said Apple Intelligence — the company's bold new package of AI features for iPhones, iPads, and Macs — was "not 100%," acknowledging that the technology was liable to making mistakes.

Such mistakes have already threatened the reputation of its peers. Google, for instance, was forced to apologize earlier this year after its generative AI image generator created historically incorrect images in response to user requests.

Race to $4 trillion

Meanwhile, Meta's AI chief Yann LeCun told The Financial Times last month that large language models, the tech powering the generative AI boom, were not going to lead to the field's holy grail of artificial general intelligence.

If others start to feel LLMs are a bit of a dead-end on that path, too, there could be a knock-on effect that impacts demand for Nvidia's chips as AI leaders try to figure out if alternative paths forward are viable.

For now, though, the industry seems intent on moving ahead with LLM-enabled generative AI. That should keep Nvidia in the race with Microsoft and Apple to a $4 trillion valuation.

Read the original article on Business Insider